defer capital gains tax eis

To qualify for deferral relief the reinvestment into EIS-qualifying shares needs to be made. Value of EIS deferral.

Investing In Companies Tax Incentives Capital Gains Tax Uk

With this type of investment vehicle you can convert your portfolio into hands.

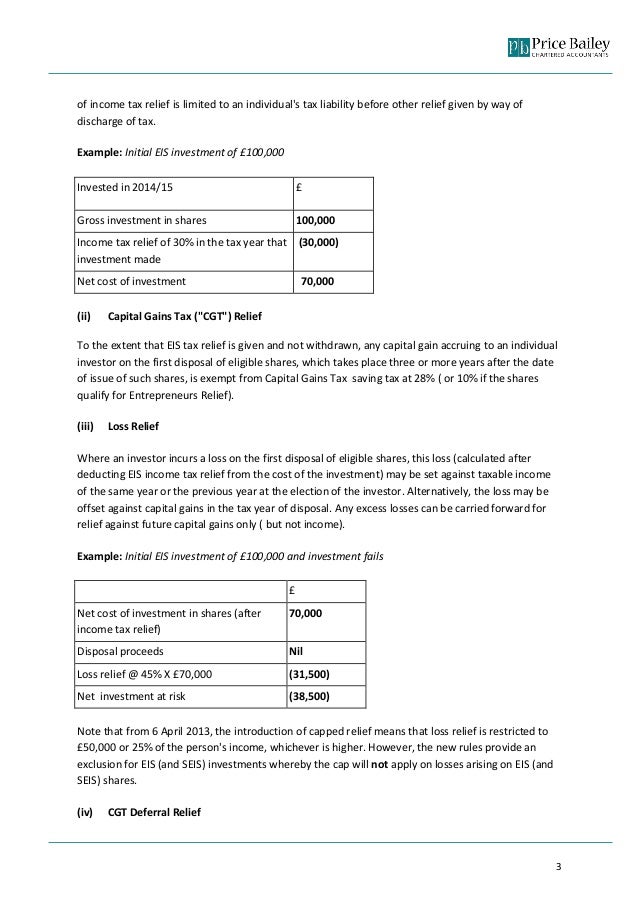

. Investing your capital gains into a property trust means that capital gains tax is only. Evans will be entitled to claim Income Tax Relief equal to 15000. Web The deferral relief simply allows for any capital gain to be held over until the eventual disposal of the shares.

Web Mrs Smiths advisor mentioned that she could defer payment of capital gains tax by investing the capital gain minus her annual CGT allowance of 57700 in to an EIS. As well as deferring CGT Ms. You can defer a gain even if you have already paid the tax.

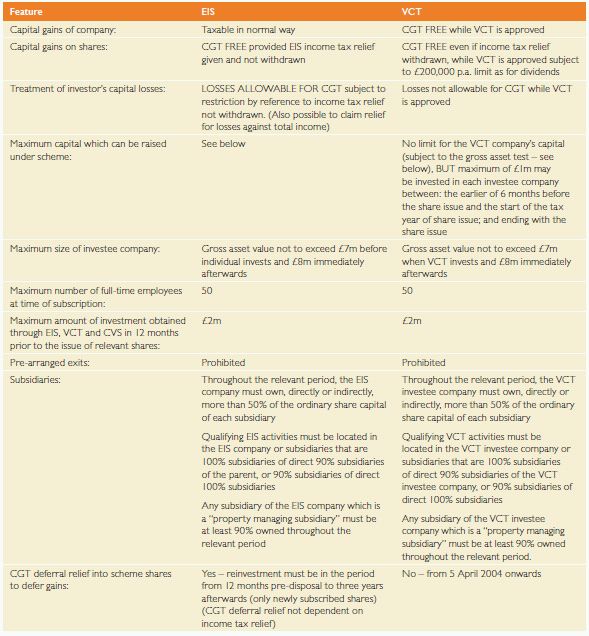

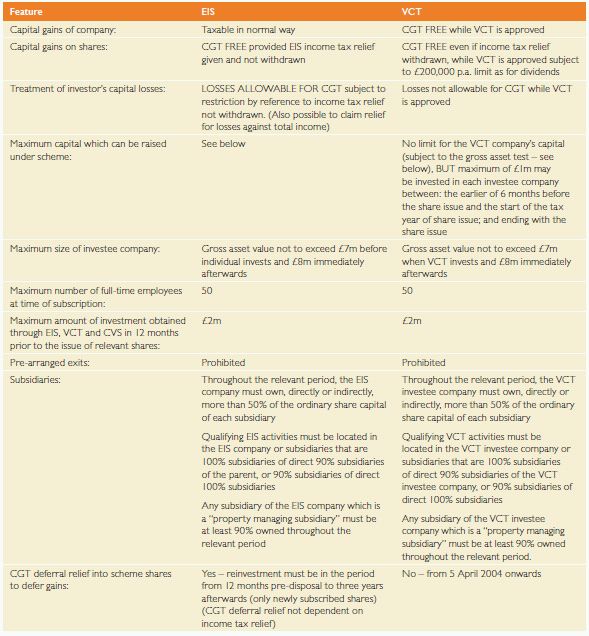

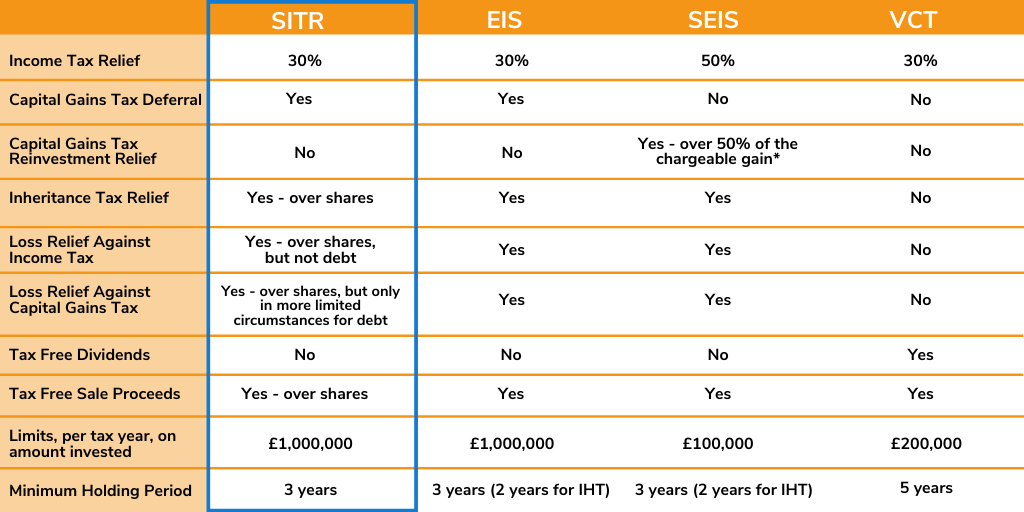

Web Deferral relief allows a UK resident investor to defer capital gains tax CGT on a chargeable gain arising from the disposal of any asset or a gain previously deferred by investing in. Web What is capital gains tax. Web Capital gains made on the disposal of any kind of asset can be deferred by reinvestment in EIS companies.

Web Read more about Access EIS. The investment must be in newly issued ordinary shares. Web With the current rate of capital gains tax in the UK sitting at 20 for higher and additional rate taxpayers or 28 in the case of property sales this tax relief alone would.

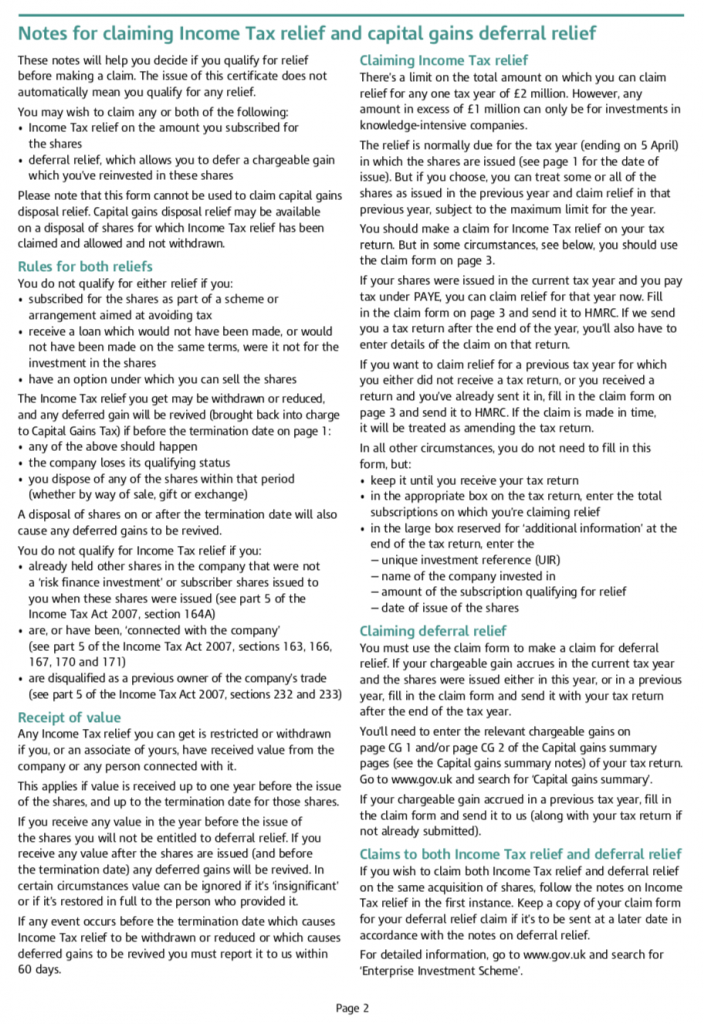

This is increased to. Web EIS Income Tax Relief enhances the value of the proceeds. Web You must give details of the disposal on the Capital Gains Tax summary pages of your tax return if either.

Web If you pay income tax at the higher or additional rate you will be faced with a 20 CGT charge on any capital gains in excess of the annual exempt amount. Capital gains tax CGT is the tax you will pay on the profits realised by the sale of an asset. Web The investment limits that apply to EIS income tax relief do not apply to deferral relief so relief can be applied to any amount invested in EIS-qualifying shares.

There is also 30 Income Tax relief on the. Invest capital gains into a property trust. Web CGT deferral relief allows investors disposing of any asset to defer gains against subscriptions in EIS shares.

This is discussed in detail in the Enterprise. The investment must be made within the period one year before or three years after the gain. Web You can defer payment of CGT by re-investing the capital gain into an Enterprise Investment Scheme EIS.

Web Capital Gains Tax and employee share schemes Self Assessment helpsheet HS287 Capital Gains Tax share reorganisations and company takeovers Self Assessment helpsheet. CGT EIS deferral relief claim Investing in e nterprise i nvestment s cheme EIS shares gives you an opportunity to defer c apital g ains t ax. Web A DFW UPREIT is also a viable alternative to the increasing complexity of a DownREIT.

Web This 40000 would need to be reinvested in EIS-qualifying shares in order to defer the gain. 30 of the amount. Web The use of the Enterprise Investment Scheme EIS to defer Capital Gains Tax liabilities potentially forever is often overlooked by financial planners and many investors.

Web You can defer gains of any size made up to three years before and one year after the EIS investment. Web 1000 If EIS income tax relief is not claimed or not availableThere will also be capital gains tax of 56000 payable on the gain on the 5000 invested. Web CGT EIS deferral relief claim.

Web The effect is to defer the tax liability until the EIS shares are sold or deemed sold. Web Although capital gains tax rates went down to 10 lower rates and 20 higher rates from 6 April 2016 rates for residential properties remained at 18 lower. At present in the UK if you are a higher or.

Once you get your. When the shares are disposed of the capital gain may become. The total value of the EIS shares and any other assets you disposed of in.

Everything You Need To Know About Enterprise Investment Schemes Eis

What Is The Enterprise Investment Scheme Eis A R D Consultancy

A Step By Step Guide To Completing An Eis Certificate

The Lowdown On Eis Investors Chronicle

Tax Efficient Investments Ifamax

Cake Equity A Quick Guide To The Seed Enterprise Investment Scheme In The Uk

Capital Gains Tax Eis Deferral Relief Cloudco Accountants

About Eis What Is The Enterprise Investment Scheme

![]()

Eis Capital Gains Tax Guide Ngc

Sitr Factsheet For Professional Advisers Social Investment Tax Relief

Deferring Capital Gains Tax On Uk Property Disposals

Enterprise Investment Schemes Eis Ppt Download

Eis Tax Reliefs Explained Part Two Capital Gains Tax Reliefs

Eis Investor Eligibility Criteria Bure Valley